Ever since digital India was born, it has nurtured the growth and transformation of many industries and sectors in the Indian market; e-commerce - e-retailing segment that serves as a marketplace - an online platform that brings together consumers with sellers is the biggest beneficiary among them.

While it’s easy to mention it as an online retail platform as it appears to be for a consumer or a seller, the mechanics and strategy behind the screen is so humongous that got my attention and made me curious to follow every buzz around the segment – especially in the past few months. I got very much excited when I noticed my notification screen popping up with a news announcement of reliance industries strategically reinventing themselves as technology platform companies with the plan to enter into the e-commerce segment and launch their online retail platform. After revolutionizing the mobile telecom segment with Jio, I am eager to see how reliance will be a game-changer in the e-commerce segment that many players like Amazon already dominate, Flipkart, Paytm, Myntra, Shopclues, Snapdeal, and a few more dot com’s

I remember clicking on a notification on my mobile; within a fraction of a second, I read “Walmart Flipkart Acquisition” US retail giant Walmart Inc buys 77% stake on India’s one of the largest online retailers Flipkart for a mega-deal of $16 billion.

A month before the above news was the announcement of PayTM, India’s leading fintech & growing online-retail company raising INR 3000cr from Japan’s Soft Bank, which acquires a 21% stake in the company. The firm is already backed by China’s leading firm, Alibaba, and Alipay, with 46% stake in the firm.

Amazon, the US firm lead by its founder Jeff Bezos announced $5 billion for the Indian operations considering the growth potential.

My curiosity increased further to study the factors influencing the firms' attractiveness to invest in the Indian E-retailing segment & the strategies that are driving the success of the firms in the industry.

Below are the basic factors that are the attractiveness of this fast-growing market in my view, but not limited to

The demography of 2nd largest population of the world

High penetration of Smartphone & Mobile network

Ease of online payment transaction

Changing consumer behaviour and expectation

India is the 8th largest consumer market in the world. The age structure of the 1.3 billion population is attractive, with 31.2% of the population are children between the age of 0-14 years and 63.6% of the population consisting of teenagers, college students, married, parents, relatively senior members of the family but overall a major group of the working population. Only 5.3% of the population is above 65 years. According to an interesting report by BCG the consumption expenditure of Indian consumers is growing at the rate of 12% is more than double the anticipated global rate of 5%, and will make India the third-largest consumer market by 2025.

India is second largest mobile market in the world

India is the 2nd biggest mobile market and accounts for 10% of the global smartphone sales. It is expected to have 530 million smartphone users across India by 2018. Internet penetration in India is likely to grow to 55% or more by 2025 when the no. of internet users reaches 850 million. It was also mentioned in the BCG report that there is a significant increase in the online buyers, the total value of e-retail to reach $130 billion to $150 billion, 8 – 10% total sales by 2025 with online buyers climbing from 300 million to 350 million by 2025 with the growth of elite and affluent households. Source: BCG analysis report.

You must have noticed I read all the news from my mobile apps!

Mobile wallets will be promoted by respective firms ; quality of internet will improve

The fast-emerging market, India, has seen a rapid increase in usage of cashless payment modes, especially after the demonetization. There has been a significant increase in the no. of payment modes such as mobile wallets, mobile banking, internet banking, credit card, and debit card usage. These are definitely shaping up the online retailing market as a major enabler towards growth and expansion. PayTM is a prominent player as it has a major subscription to its mobile wallet app. other apps include NPCI UPI, Mobikwik, Phonepe, Google Tez. Amazon is trying to attract their consumers towards amazon pay. Flipkart acquired Phonepe in April 2016. Cash on delivery is also available with most e-retailing firms. Reliance will have the edge over the other firms as it enters the segment with the power of Jio, which is focusing on both the mobile internet penetration and the Jio money. The size of the eCommerce will hit US$ 200 bln by 2026, according to ibef report

Electronics and apparels are the most consumer products among consumers; Online groceries are picking up well with the focus of bigbasket.com, amazon pantry. The baby products, beauty, and personal care books still have their preference to buy online. Home and furnishing are showing improvements in the marketplace with more awareness. This is where consumer behavior is still requiring the touch and feel of the offline brick-and-mortar stores. The trust with e-retailing is continuing to grow with more promotions and awareness. These firms incentivize the consumers to purchase online with lower price availabilities, free deliveries, and return policies. The omnichannel expectation of the Indian consumers still prevails dominant and is a greater challenge for the e-retailing firms.

Let’s look at the strategies,

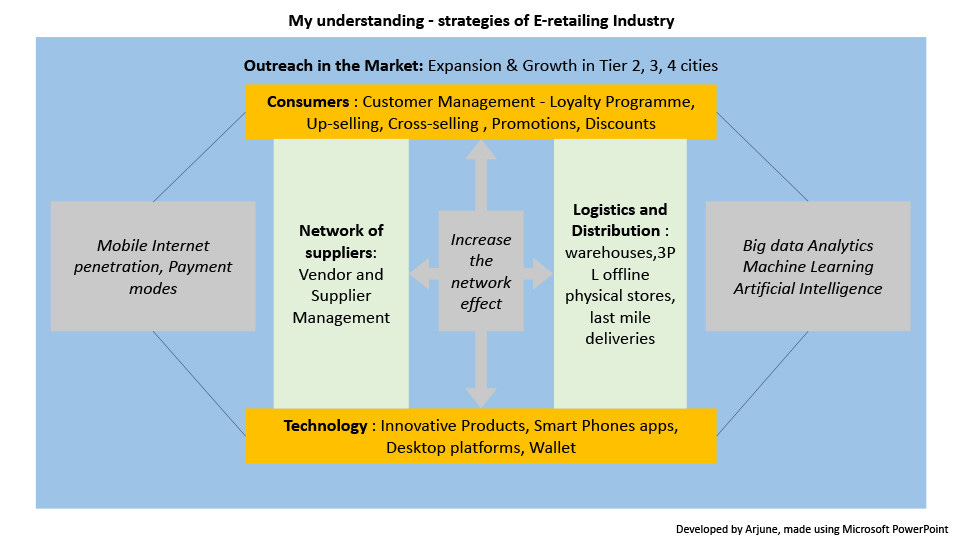

While these firms' strategies are more appearing to be influenced by “economies of scale” and/or “economies of scope.” E-retailing is the best example of the segment where I can see firms maximizing values through cross-selling and up-selling. It got interesting when I was trying to understand the firm's strategy towards a product, operation, supply chain, and consumer, which I grouped as the main pillars that form the backbone for India's e-retailing segment noticed that a pattern that these firms had one or more combinations of these pillars as their core-competence, which helped to acquire more customer base. They also signal the strengths and weaknesses of these firms.

The five main pillars that forms the back bone of the e-commerce in India to according to me,

1. Technology & Innovation

2. Customer management

3. Network of suppliers

4. Logistics and Distribution

5. Outreach the Market

To increase the firms network effect in both the supply and demand side

Technology & innovation includes the development of an online marketplace such as mobile apps and desktop websites. It’s even more how the mechanics and algorithms work behind the screen to increase the network effect. This is where big data analytics comes into the picture for analyzing the consumer's activities and past purchase behavior and linking it to the activities to predict or to anticipate the next item that a consumer will purchase. This is linked to the availability: getting the item closer to the consumer to speed up the delivery. Machine learning and artificial intelligence play a key role in understanding and helping the industry understand customers' behavior to provide better solutions. In simple words, these technologies help the firms to list the interesting items that a consumer is likely to buy on-screen upon login and influencing him/her to buy it and complete the transaction.

Customer management is more to increase customer loyalty towards the firm and to cause a positive network effect. To provide a rich consumer e-retailing experience, retain and encourage repeated purchases using the above technologies and product offerings. Obviously, it is to increase traffic, and in the end, it’s all about increasing the no. of subscription on consumers with their firm. This provides major data for these firms to perform data mining and the buzz word big data analytics. Amazon offers amazon prime, a kind of loyalty subscription program, amazon pay. Flipkart has the plus program with the benefits of faster delivery, return policies, etc. At present, there is a meager switching cost for the consumers, and the competition between the firms with promotional events and discounts is also increasing the firms' costs. The challenge here will be to reduce the firm's costs and differentiate to make the switching costs higher for the consumers.

For me, as a prime member, Amazon has the most product categories offered along with the e-retailing options that include amazon prime video, amazon prime music, the Kindle readers. They also offer the private labeled item with amazon basics at a lower price. At the same time, Walmart-backed Flipkart offers the experience part with faster delivery with its plus accounts. I strongly feel Amazon will face tough competition from reliance e-retail than Flipkart as Reliance Industry has Jio mobile internet service provider. It offers the whole package with the MyJIO app, including JioMoney, Jio TV, JioMusic, JioCloud, JioNews, JioChat. I like the Jio4GVoice app that makes an app into a phone using a wifi-router. The Alibaba-backed Fintech PayTM offers almost equal products except for the music, movie, and cloud, but besides, they provide recharge, bill payments, ticket booking services. PayTM started with the mobile bank recently. These are certainly consumer attractions with economies of scope.

The network of suppliers is basically to increase the network effect of vendors and supplier base. It depends on the network effect, i.e., traffic and the no. of subscription of consumers that the firms have. The more the traffic, the more the orders and the supply chain keep moving busily as it will attract more suppliers and vendors to list the products on the marketplace platforms. This allows keeping the costs low for the supplier with the help of predictive analysis using the technologies with proper forecasts and maintaining economies of scale. Offering attractive incentives to the suppliers and negotiating payment terms. Also, having a low-cost supplier is important for the firms because of prevailing competition between the e-retailing firms. Walmart, in my understanding, has the competence and can enhance Flipkart with its learning; they will still need to adapt to the local regulations, and here is where the local competence of Flipkart can go handy for Walmart.

This certainly opens up the market and growth for the small and medium scales industries in India.

The logistics and distribution play the major role as it fulfills the major part of the consumer experience. The delivery of the ordered consumer goods in good condition and in the given time is considered as quality service. Any consumer mostly expects a faster and prompt delivery. Significance improvement has been seen in the operations of the e-retailing firms with the establishment of warehouses. E.g. Amazon and Flipkart. Amazon has the most advanced fulfillment centers and transportation services. Flipkart also has its own distribution network, namely Ekart logistics, and Walmart can bring its high expertise on the supply chain management to Flipkart.

Omni channel experience of the consumers drives the firms strategy

In recent times, the shift from online to offline and Offline towards online is happening with the Amazon stepping into the physical stores, Walmart acquiring Flipkart, the announcement of Reliance industries plan to venture into e-retail. This shows customers' omnichannel experience requirement still plays a role in the firm's strategies and business model. Reliance can make use of its Jio outlets as touchpoints for its e-retail consumers. Amazon is already trying out with the local shops to be the delivery pick-up points.

Outreach the market, as mentioned in the statistics, all the factors influencing the e-retail segment are expected to penetrate the tier 2, 3 cities, and rural segments. This offers a great market penetration and expansion for growth for the firms in e-retailing. Therefore the above-said pillars form the strengths and weaknesses of the firms. The competing firms that are stronger with the factors and the network effect continue to expand in the other tier cities, and rural regions have the most way to become the leader in the Indian retailing segments. All the operations above will also create huge employment opportunities in the emerging Indian market.

This summarises my findings and understanding of the e-retailing segment, and I feel there is a lot more to learn. Looking forward to much more interesting news, changes, and innovative transformations in this segment.

If you had reached here, you must have found it interesting. Please do like, leave comments or messages to add your ideas and comments.

Disclaimer: Ideas and views expressed in this article are my own views based on the understanding from references in the links provided within articles and learnings from my business studies, personal experience, and assumptions. The article is only for reading and does not rely on them for any purpose or executions. The respective companies own the logo and webpage on the pictures. With due respect, utmost care is taken to provide credits with the sources' links for the information obtained from an internet source. Please read through the articles and reports in the link; it's interesting.

Thank you for your time and reading!

#India #eretailing #Amazon #Amazonpay #Amazonprime #Walmart #Flipkart #online #Ecommerce #Reliance #Jio #Marketplace #Paytm #Snapdeal #Alibaba #Strategy #Competitivestrategies #mba #ISB #Consumers #fintech #mobilebanking #market #attractiveness #emergingmarket #growingeconomy #consumermarket